CA Announces Big Win in Battle Against Asbestos

February 18, 2022Over 100 Students, Teachers, and Staff Diagnosed with Rare Cancers After Attending a New Jersey High School

April 27, 2022Social Security

Social Security provides benefits to over 65 million Americans. They provide at least 50 percent of income for those 65 and older in the U.S. If you are looking to retire, you may have some questions about Social Security. Find some FAQs from AARP below that may be helpful:

- Is Social Security just for retired workers?

No. As of December 2021, 72.5 percent of beneficiaries were retirees. The remainder were spouses, ex-spouses and children of retirees (4.4 percent); disabled workers and their families (14.1 percent); and survivors of deceased beneficiaries (9 percent).

- At what age can I start collecting Social Security benefits?

You can begin receiving retirement benefits at age 62, but your payments will be greater if you wait until your full retirement age (66 years and 2 months for people born in 1955, 66 and 4 months for those born in 1956, and gradually rising over the next several years to 67). If you are eligible for survivor benefits or Social Security Disability Insurance (SSDI), you can start collecting earlier.

- How do I sign up for Social Security?

You can apply for retirement, spousal or disability benefits online or by phone at 800-772-1213. For survivor benefits, you can apply by phone. Local Social Security offices have been largely closed to in-person visits since March 2020 due to the COVID-19 pandemic, but once they reopen you can also file for all types of benefits in person.

- How long do I need to work to become eligible for benefits?

For retirement benefits, at least 10 years. Social Security uses a system of credits, which you collect by working and paying Social Security taxes. You can earn up to four credits a year, and you need 40 credits to qualify for retirement benefits. The credit threshold may be lower for disability benefits.

- Must I stop working to collect retirement benefits?

No, you can receive benefits while working. But if you are below full retirement age and earn more than a certain amount, your monthly benefits will be temporarily reduced. Once you reach full retirement age, the reduction is eliminated, and your benefits will be increased to make up for what was lost over time.

Increased Cost of Living benefit

One of the biggest changes for Social Security in 2022 is the 5.9 percent increase for Cost of Living Adjustment (COLA). This will increase beneficiaries’ checks by $92 to $1,657 a month.

Beneficiaries on limited incomes will see their checks increase by $47 for individuals and $70 for couples.

Subtraction for Work

Most Social Security retirement benefits are designed for those who are no longer working. If you are earning money and collecting Social Security retirement benefits before you reach full retirement age (which Social Security will calculate for you), they may withhold $1 in benefits for every $2 in earnings that exceed the threshold. In 2021, the threshold was set at $18,960. In 2022, the threshold was raised to $19,560.

When you reach full retirement age, Social Security will withhold $1 for every $3 you earn above the limit. In 2021, the limit was $50,520; in 2022, it is $51,960. They will stop withholding money the month you reach full retirement age.

You will not lose the money that they withhold. They will increase your monthly benefit at full retirement age and you can recoup benefits that were withheld.

Taxes

Social Security is paid for by a 6.2 percent tax on employees, which is matched by a 6.2 percent tax from employers. Self-employed people pay 12.4 percent. Because of the COLA benefit increase, the amount paid by working individuals has increased to cover the cost. In 2021, employed people paid Social Security tax up to $142,800 of taxable earnings. In 2022, that limit was increased to $147,000.

Medicare

Medicare consists of four basic parts that include coverage from hospital care to prescription medication.

Part A — Hospital coverage

When you apply for Medicare, you are automatically enrolled in Part A. It covers hospital stays, hospice care and some skilled nursing care.

Most people don’t have to pay a premium for Part A, but it isn’t completely free.

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2022 the deductible is $1,556. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

Medicare pays for virtually all hospital services for the first 60 days you’re in the hospital.

If you are a U.S. citizen or permanent resident and have not worked long enough to qualify for Medicare, you may able to buy into the program by paying a Part A premium.

Part B — Doctor and outpatient services

Part B covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation, and other outpatient services.

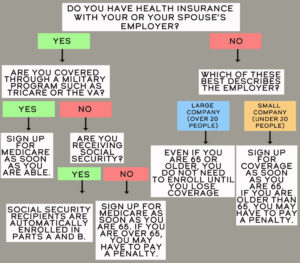

Part B has more costs associated with it. You may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouse’s health plan. However, if you don’t have other insurance and don’t sign up for Part B when you enroll in Medicare, you’ll likely have to pay a higher monthly premium while in the program.

The federal government sets the Part B monthly premium, which is $170.10 for 2022. It may be higher if your income is more than $91,000.

You’ll also have an annual deductible, set at $233 for 2022. In addition, you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Part C — Medicare Advantage

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. It’s like a one-stop shopping choice that combines various parts of Medicare into one plan.

If you choose Medicare Advantage, you’ll still have to enroll in parts A and B and pay the Part B premium. Then you will choose a Medicare Advantage plan and sign up with a private insurer.

The federal government requires these plans to cover everything that original Medicare covers, and some plans pay for services that original Medicare does not including dental and vision care. Recently Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover wheelchair ramps, shower grips, meal delivery and transportation to and from doctors’ offices.

Part D — Prescription drugs

Part D of Medicare pays for some of your prescription drugs. Part D is a plan you buy through a private insurer.

Part D plans usually come with premiums and other out-of-pocket costs in the form of flat copays for each medication or a percentage of the prescription costs. It also may have an annual deductible.

If the total you have paid for Part D reaches $4,430 in 2022, you will be responsible for 25 percent of the price of the rest of the prescription drugs you buy during the year.

Be sure to check medicare.gov to see if the plan you’re considering has the medicines you take are covered on the formulary. The lists change often so be sure to recheck during open enrollment periods.

Do You Have Health Insurance Through Your or Your Spouse’s Employer?

Medicare Changes for 2022

Medicare’s biggest change comes in the form of higher premiums and deductibles for medical care for those who are 65 and older and for people with disabilities.

The benefits will remain largely the same. Congress has several proposals in the works to add hearing aid benefits, lower the price of prescription drugs, and capping out-of-pocket costs in Part D plans. If they do happen to pass, they will not take effect this year.

Large Increases for Medicare Part B

Part B, the monthly premium that covers doctor visits and outpatients services will increase more than $20 per month. The increase comes from rising health care prices, Congress-enacted increases due to the COVID-19 pandemic, and the fact that the Centers for Medicare & Medicaid Services (CMS) wanted to set aside more funds incase Medicare decides to cover Aduhelm, a drug to treat Alzheimer’s.

Some of the Part B increase will be offset by the 5.9 percent increase in Social Security’s annual COLA. People enrolled in Medicare and Social Security benefits will get their premium deducted from their monthly Social Security check.

Besides the premium increase, deductibles for Part B will be increased by $30.

For Medicare Part A, which covers hospitalizations, hospice, and some nursing and home health services, will see an increase of $72.

Medicare Coverage Improvements

Medicare enrollees will be able to sign up for a Part D “enhanced” plan that will cap costs of some insulins at $35 a month.

Medicare is also planning to focus more on mental health benefits via telehealth.